By Donald J. Boudreaux

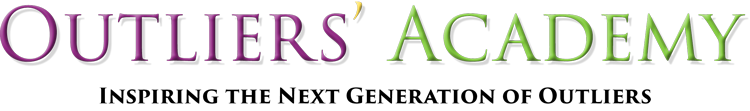

Frédéric Bastiat (1801-50) is known today among economists—if he is known at all—as at best a brilliant polemicist. An economic theorist he most certainly was not—such is the common opinion.

I believe this common opinion to be mistaken. To explain why first requires a discussion of the nature of a theory.

A Theory Is a Story

As I tell students in my Principles of Microeconomics courses, a theory is a story that assists us in making better sense of reality. And a theorist is a storyteller who offers this assistance.

A story that explains the price only of bread is not a proper theory of prices, even if it is highly believable.

Stories, of course, differ in their believability. A story that explains, say, the Industrial Revolution as being the result of new knowledge imparted to us by aliens from another galaxy is completely unbelievable. Some other, more believable story is called for—one, say, that features a change in people’s attitudes toward commerce and innovation.

But for a story to deserve to be called a theory requires that it also be generalizable.

In economics, supply-and-demand analysis is a general account of how prices are formed and change. It’s not a story about the formation of the price of only one item, such as bread. It’s an outline for telling believable stories about the formation of all prices—from the prices of toy planes to those of jumbo jetliners, from the wages earned by motel maids to those earned by Tom Hanks. A story that explains the price only of bread is not a proper theory of prices, even if it is highly believable.

To be generalizable, a story whose creator wishes it to be regarded as a serious theory must make that story abstract. Being abstract, however, makes the story—standing alone—barren. As such, it engenders no understanding of the physical or social world. But it proves itself to be a good theory if, when relevant details of reality are added to it, those of us who encounter this story go, “Aha! Now I understand reality better than I did before!”

The core purpose of all theories is the creation of improved understanding. A theory that does not cause those who hear or read it to go, “Aha!” is worthless.

Bastiat the Theorist

And so we return to Bastiat. He’s one of history’s most brilliant tellers of economic stories. This fact, I’m convinced, justifies calling Bastiat a great economic theorist.

Who can read Bastiat’s satirical portrayal of sunlight as an unfairly low-priced import and not go, “Aha!”

Consider Bastiat’s famous 1843 “Petition of the Manufacturers of Candles.” In this short essay, Bastiat radiantly conveyed economists’ understanding that artificially contrived scarcities make the general population worse off even if they increase the wealth of a small handful of individuals. Who other than the most benighted protectionist can read Bastiat’s satirical portrayal of sunlight as an unfairly low-priced import and not go, “Aha! Of course, inexpensive imports that ‘flood’ into a country no more impoverish that country than does the light sent to us free by the sun!”

Another example is Bastiat’s even-shorter essay “A Negative Railway.” Here Bastiat revealed the flaw in the argument of a gentleman who insisted that if a railroad connecting Paris to Bayonne were forced to have a stop at Bordeaux, the wealth of the French people would be enhanced. The hapless target of Bastiat’s brilliance based his conclusion on the correct observation that forcing trains to stop at Bordeaux would increase the incomes of porters, restaurateurs, and some other people in Bordeaux.

Yet Bastiat didn’t settle for drily noting that, after paying these higher incomes, railways and their passengers would have less money to spend on goods and services offered by suppliers in locations other than Bordeaux. Instead, Bastiat followed the proposal’s logic in a way uniquely revealing: If forcing trains to stop at Bordeaux will increase the total wealth of the people of France, so too will the total wealth of the people of France be increased if trains are obliged to stop also at Angoulême. And if also at Angoulême, then the French will be enriched even further if a third stop is required at Poitiers. And if at Poitiers, then at each and every location between Paris and Bayonne.

Bastiat revealed the proposal to be flawed by showing that, if its logic were sound, the railway that would do the most good for the French people is one that is nothing but a series of stops—a negative railway!

Do you find these posts helpful and informative? Please CLICK HERE to help keep us going!